Escale suas vendas com WhatsApp API Oficial

Com a solução de disparo mais rápida e confiável do mercado. Para entregar a mensagem certa ao cliente certo, no momento certo!

Escolhida pelas empresas que mais crescem no Brasil

Escolha a ZapCerto para:

Aumentar a sua taxa de conversão e fidelização

Levar sua mensagem ao momento certo de compra do seu cliente

Aumente a eficiencia e os resultados das suas campanhas de marketing

Levar sua mensagem a cada vez mais pessoas

Engajar o público para comprar seu perpétuo ou lançamento

A ZapCerto entrega resultados mensuráveis sem desperdícios de recursos

Nossos Recursos

Sniper List:

A parceira ZapCerto que impulsiona seu crescimento B2B. Desvende o cliente ideal, localize empresas compatíveis, identifique os principais decisores e inicie conexões estratégicas. O segredo para acelerar seu sucesso empresarial.

Whatsapp Business API

Automatize envios em massa e crie automações personalizadas, transformando seu WhatsApp numa poderosa Maquina de Vendas. Acelere seu negócio com soluções eficientes e personalizáveis.

SMS marketing e Ligações automáticas

Nem só de WhatsApp vive o Growth! Complemente suas réguas de comunicação com SMS e ligações automáticas para gerar ainda mais engajamento e aquecer seus leads usando links personalizados e reconhecimento de voz por AI.

Rastreamento detalhado

Através dos nossos links encurtados e rastreáveis você sabe o impacto que cada ação está gerando e consegue testar quais formas de comunicação trazem o maior retorno para a sua empresa.

Cases de uso da ZapCerto :

Previous

Next

Modelo MASSIVO

Personalização ▷ Escala ▷ Velocidade

Capacidade de envio de milhares de mensagens de WhatsApp por hora, de forma individual para uma lista de leads, sem usar a sua base de números, sem bloqueios e sem stress.

Foto e nome de perfil personalizados. Possibilidade de adicionar vídeo e imagem anexados ao texto.

Botões com links personalizáveis. Leve o lead direto para o destino que você desejar com apenas um toque.

"Fazendo a mensagem certa, chegar no cliente certo no momento certo"

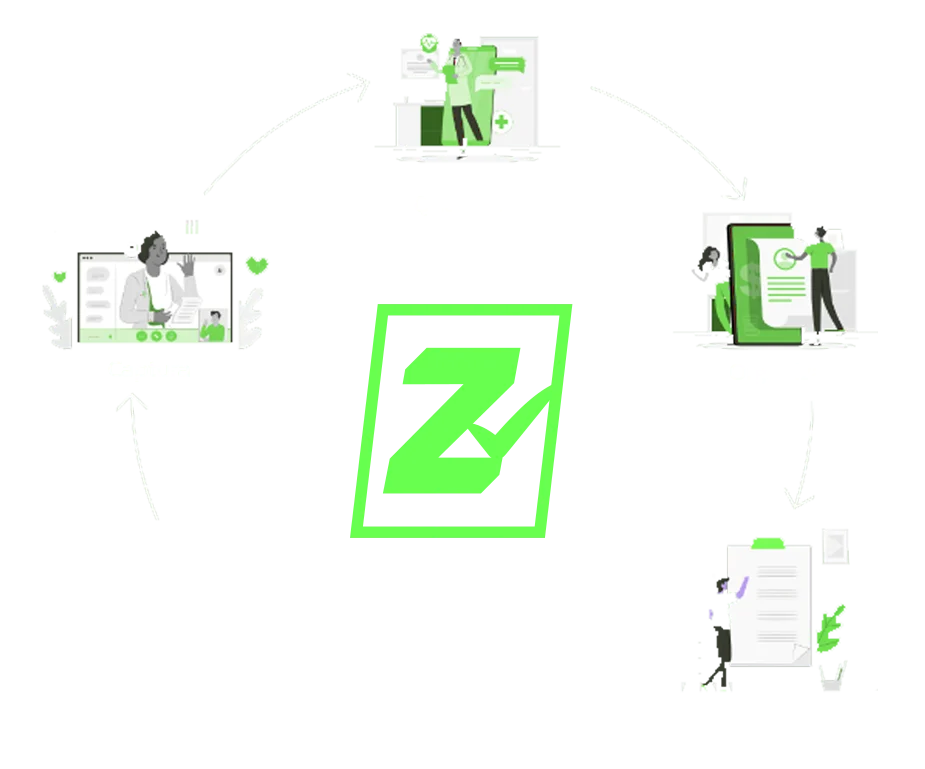

Processos

A ZapCerto coloca o usuário no centro das suas operações, e prioriza a experiência do cliente no momento do atendimento, seja humanizado, com chatbots ou híbridos.

Temos integrações de webhook com os principais checkouts e CRM do Brasil.

Aproveite nosso serviço de implementação que usa tecnologia de dados para construir uma maquina de gerar clientes para o seu negócio!

Atalhos

Parceiros oficiais